How Much Study Time to Become a CPA in Canada?

Whether you have not yet begun the CPA journey or are an existing CPA candidate part way through the CPA Professional Education Program (PEP), you may be wondering what kind of time commitment lies ahead of you to obtain the CPA designation.

CPA Canada Program Structure (Pathway)

The CPA Canada program is structured to have candidates pass through various core, elective, and capstone modules, before attempting the Common Final Examination (CFE). A helpful map of the program is provided below:

How Much Study Time Does It Take to Become a Canadian CPA?

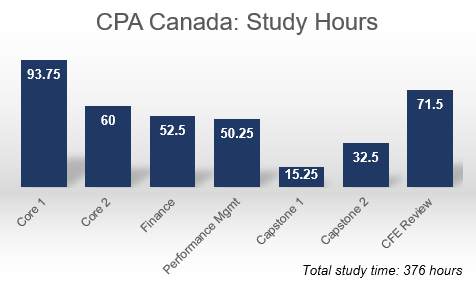

As someone who obtained the CPA designation (Ontario), I can shed some light on my personal experience with the program as I religiously kept track of my study and case-writing time. Unlike for the CFA exam which has a well-known rule of thumb that candidates should expect to study 300 hours per level, there does not seem to be much data on study time for the CPA, and especially not the Canadian CPA.

My CPA journey involved 375.75 hours of study.

Note that the study hours include independent study time and any time spent writing cases or quizzes. In terms of the capstone modules, the time tracked was anything to do with the capstone (ex. case-writing, practicing presenting, etc.)

Core 1 (93.75 hours)

Note that as the new CPA program was rolling out at around the time I begun the journey, I was able to challenge Cores 1 and 2. This means that I did not have to complete the entire PEP modules, rather, I merely wrote the end-of-module exam. Nonetheless I was responsible for knowing the material just as well as all of the candidates who participated in the full modules. On one hand I certainly saved some time by focusing my study efforts, however, I lacked the guidance that module participants received. I wrote Core 1 relatively quickly after graduating with my Bachelor of Accounting degree so the technical material was still somewhat fresh.

Core 2 (60.00 hours)

As described above, I had the opportunity to write the challenge exam for Core 2 as opposed to participating the full PEP module. The Core 2 topic areas felt lighter to me personally, and therefore I felt ready to write the exam with merely 60 hours of study. Core 2 focused more on management accounting as opposed to financial accounting, which I personally felt was beneficial as I find management accounting concepts easier to grasp.

Elective 1: Finance (52.50 hours)

At this point in my CPA journey I was a full CPA PEP participant, completing the full PEP modules with weekly cases, quizzes, and the infamous weekend workshop. Candidates are likely to select an elective they feel they are strong at or interested in, so naturally not every candidate will select finance. For me personally it was an easy choice given I was currently working in Mergers & Acquisitions at Deloitte and had a CFA exam under my belt, allowing me to realize some synergies in terms of topics covered.

Elective 2: Performance Management (50.25 hours)

I took a hiatus from the CPA program for nearly two years during COVID-19 as I was focused on wrapping up the CFA designation during this time. Unfortunately the pandemic caused several delays related to the CFA, which pushed back my timeline for completing both designations. The key takeaway from this context is that I had not visited CPA material for a significant amount of time before tackling the Performance Management elective module and I was now a few years out from undergrad. Nonetheless, the time commitment was the smallest yet.

Capstone 1 (15.25 hours) and Capstone 2 (32.50 hours)

The Capstone modules are essentially preparation for the Common Final Exam (CFE), in module format. Candidates are given the opportunity to complete a plethora of practice cases if they wish, however not all are marked, therefore there is significant variance in the time commitment candidates will have as it is largely your choice. For clarity, I personally took advantage of every marked practice case that was available, however, I did not elect to do many more beyond that.

Common Final Exam (CFE) Preparation (71.50 hours)

Beyond the formal modules described above, I decided to review technical content in preparation for the CFE. It’s important to note that at this point it had been over two years since I had any exposure to certain subjects (i.e. taxation) and therefore was essentially learning from scratch. Candidates who complete the CPA program over a shorter timeline likely will not need to review and re-learn as much material as I did in preparation for the CFE.

Final Thoughts: Total Study Time (375.75 hours)

While the 375.75 hour figure may sound daunting, in my opinion it is far from unmanageable. Keep in mind that these hours would typically be spread across ~2 years or so, which means on average candidates would need to study around 30 minutes per day for those two years. Furthermore, a lot of the above hours are not pure study time. Much of the time is actually case-writing, which personally I found fairly engaging. In comparison to the CFA process, the Canadian CPA was a substantially smaller commitment, though a comparison between the two will be covered in a separate blog post.

New or existing CPA candidates looking for more resoureces are encouraged to read other blog posts found on this site. Chartered Perspective is pleased to offer several resources to aid you in your CPA journey, particularly surrounding the Practical Experience Reporting (PER) requirements.